Table of Contents

- Direct Taxation

- Indirect Taxation

- Ministry of Corporate Affairs (MCA)

- Micro, Small & Medium Enterprises (MSMEs)

- Others

Direct Taxation

Extension of various time limits under Direct Tax & Benami laws

Employees allowed to claim Income Tax exemption on conveyance allowance under new tax regime (Section 115BAC of the Act)

Higher penal interest on delayed tax payments

In her March press conference, the finance minister announced a relaxation on the penal interest levied on the delayed payments of advanced tax, self-assessment tax, regular tax, TDS, TCS, equalization levy, STT, CTT made between March 20, 2020 and June 30, 2020.She stated that a reduced interest rate at 9 per cent instead of 12 per cent /18 per cent per annum (i.e., 0.75 per cent per month instead of 1/1.5 per cent per month) was to be charged during this period. No late fee/penalty shall be charged for delay relating to this period.

Any delayed tax payment made after June 30, 2020 will attract penal interest of 12 per cent /18 per cent as applicable instead of 9 per cent.

Section 194N – TDS on cash withdrawals over Rs 1 crore

Indirect Taxation

CBIC extends validity of e-way bills in new set of relaxations

SC stays Delhi HC order on transitional GST credit on Centre’s SLP

CBIC launches paperless customs export processing

Highlights of 40th GST Council Meet

- Measures for Trade facilitation:

- Reduction in Late Fee for past Returns:

- ‘NIL’ late fee if there is no tax liability;

- Maximum late fee capped at Rs. 500/- per return if there is any tax liability.

- Certain clauses of the Finance Act, 2020 amending CGST Act 2017 and IGST Act, 2017 to be brought into force from 30.06.2020. Read more

Ministry of Corporate Affairs (MCA)

Ministry of Corporate Affairs widens ambit of CSR activities

MCA amends the Share Capital and Debentures Rules

MCA vide notification dated 05th June, 2020 has made the following amendments in the Companies (Share Capital and Debentures)Rules, 2014:Now, a start-up company can issue sweat equity shares not exceeding 15% of its paid-up share capital upto 10 (ten) years from the date of incorporation. Earlier the time period was 5 (five) years. Read more

MCA extends timelines for creation of DRR up to 30th September, 2020

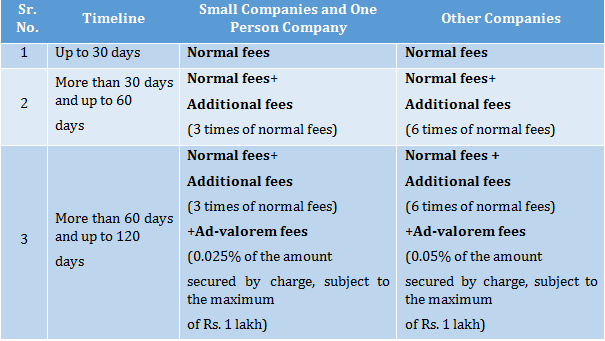

Scheme for relaxation of time for filing forms related to creationor modification of charges under the Companies Act, 2013

On account of the pandemic caused by the COVID-19, MCA has introduced a ‘scheme for relaxation of time for filing forms related tocreation or modification of charges’ for the purposes of condoning the delay in filing certain forms related to creation/ modification ofcharges. Read more

The timelines applicable for filing the charge creation/ modification forms are as under:

Micro, Small &Medium Enterprises (MSMEs)

PM launches technology-based solution CHAMPIONS to provide one stop solutions to MSMEs

Ministry of Micro, Small and Medium Enterprises (MSMEs) launches another funding scheme to help the distressed MSME sector

Minister of MSME, Shri Nitin Gadkari launched the Credit Guarantee Scheme for Sub-ordinate Debt (CGSSD) which is also called “Distressed Assets Fund–Sub-ordinate Debt for MSMEs”.As per the Scheme, the guarantee cover worth Rs. 20,000 crores will be provided to the promoters who can take debt from the banks to further invest in their stressed MSMEs as equity. Read more

Consolidated notification regarding MSMEs (to be known as Udyam)

Ministry of Micro, Small and Medium Enterprises (MSME) has come out with a consolidated notification in the form of guidelines forclassification and registration of MSMEs on 26th June, 2020.The notification clarifies that Exports of goods or services or both shall be excluded while calculating the turnover of any enterprisewhether Micro, Small or Medium. Read more

Others

RBI extends enhanced borrowing limit under Marginal Standing Facility (MSF) till September 30

SEBI further relaxes compliance requirement for portfolio managers

SEBI has eased compliance requirement for portfolio managers amid prevailing business conditions amid coronavirus pandemic.In a circular, Securities and Exchange Board of India (SEBI) said it has extended the timeline for compliance with the requirements of portfolio manager’s guideline regarding upfront fee, among others, by further three months till October 1, 2020. Read more

SEBI relaxes pricing norms for preferential issues of listed companies

The Securities and Exchange Board of India (SEBI) has relaxed the pricing norms for preferential issuances to ease the capital-raising process for listed companies.The new pricing formula for allotment of shares under the preferential issue will be higher of the average 12-week price or 2-week price. Read more

SEBI makes raising funds easier for stressed companies

SEBI allows promoters to increase stake by up to 10%

No coercive action against private firms for non-payment of full wages during lockdown: SC

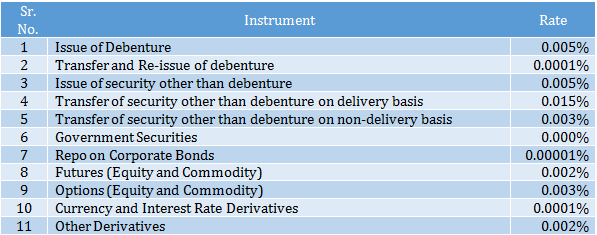

Stamp duty on buying of shares and mutual fund units