Direct Taxation

CBDT grants further relaxation in electronic filing of Income Tax Forms 15CA/15CB.

The Central Board of Direct Taxes on 20th July 2021 has further granted relaxation in electronic filing of Income Tax Forms 15CA/15CB in view of difficulties reported by the taxpayers in the filing of forms online on the new e-filing portal.

The Taxpayers can now file form 15CA and Form 15CB manually to the authorized dealers till 15th August 2021. Authorized dealers are advised to accept such Forms till 15th August 2021 for the purpose of foreign remittances. A facility will be provided on the new e-filing portal to upload these forms at a later date for the purpose of generation of the Document Identification Number.

According to the Income Tax Act, 1961, there is a requirement to furnish Form 15CA/15CB electronically. At present, taxpayers upload the Form 15CA, along with the Chartered Accountant Certificate in Form 15CB, wherever applicable, on the e-filing portal, before submitting the copy to the authorized dealer for any foreign remittance.

Income Tax (18th Amendment) Rules,2021

The Central Board of Direct taxes through a notification dated the 2nd of July 2021 has issued the Income-tax Amendment (18th Amendment), Rules, 2021. The amendment provides that:

In case of the amount which is chargeable to income-tax as income of specified entity under the head Capital gains, the specified entity shall furnish the details of the amount attributed to capital asset remaining with the specified entity in new Form No. 5C.

Form No. 5C shall be furnished electronically either under digital signature or through electronic verification code and shall be verified by the person who is authorized to verify the return of income of the specified entity under section 140.

Link: https://www.incometaxindia.gov.in/communications/notification/notification_76_2021.pdf

Income Tax (19th Amendment Rule)

The Central Board of Direct taxes through a notification dated the 7th of July 2021 has issued the Income-tax Amendment (19th Amendment), Rules, 2021. The amendment inserts new rule 8AC which provides the manner in which:

The amount of short-term capital gains shall be determined.

Where the goodwill of the business or profession was the only asset or one of the assets in the block of asset “intangible” for which depreciation was obtained by the assessee in the assessment year beginning on the 1st day of April 2020, the written down value of this block of an asset for the previous year relevant to the assessment year commencing on the 1st day of April 2021 shall be determined.

Link: https://www.incometaxindia.gov.in/communications/notification/notification_77_2021.pdf

Income Tax (20th Amendment) Rules,2021

The Central Board of Direct Taxes on 27th July 2021 has issued the Income-tax (20th Amendment) Rules, 2021. The amendment has revised the procedure for filing and assessment of return of income and fringe benefits. The amendment provides that:

where a return of income relates to the assessment year commencing on the 1st day of April 2020 or any earlier assessment year, it shall be furnished in the appropriate form as applicable in that assessment year.

Previously this provision was applicable only for returns for assessment years till 2019. This amendment shall come into effect immediately.

Link: https://www.incometaxindia.gov.in/communications/notification/notification_82_2021.pdf

Income Tax (21st Amendment) Rules,2021

The Central Board of Direct Taxes through a notification dated 29th July 2021 has issued the Income-tax (21st Amendment) Rules, 2021. The amendment allows the Principal Director General of Income-tax (Systems) or the Director-General of Income-tax (Systems), as the case may be, with the approval of the Board, to specify that any of the Forms, returns, statements, reports, orders, by whatever name called, prescribed in Appendix II, shall be furnished electronically:

Under digital signature, if the return of income is required to be furnished under digital signature; or

Through electronic verification code in all other cases.

The Principal Director General of Income-tax (Systems) or the Director-General of Income-tax (Systems) is also allowed to lay down the data structure, standards and procedure of furnishing and verification of such Forms, returns, statements, reports, orders, including modification in format, if required, to make it compatible for furnishing electronically. They shall also be responsible for formulating and implementing appropriate security, archival and retrieval policies in relation to the said Forms, returns, statements, reports, orders.

Link: https://www.incometaxindia.gov.in/communications/notification/notification_83_2021.pdf

CBDT Guidelines regarding receipt of any capital asset or stock in trade or both by a specified person from a specified entity.

Central Board of Direct Taxes through Circular dated 02 July 2021 has issued Guidelines under section 9B. This section mandates that whenever a specified person receives any capital asset or stock in trade or both from a specified entity, during the previous year, in connection with the dissolution or reconstitution of such specified entity, then it shall be deemed that the specified entity has transferred such capital asset or stock in trade or both, as the case may be, to the specified person (hereinafter referred to as “deemed transfer”.

For the removal of doubt, it is further clarified that in case the capital asset remaining with the specified entity is forming part of a block of asset, the amount attributed to such capital asset under rule 8AB of the Rules shall be reduced from the full value of the consideration received or accruing as a result of subsequent transfer of such asset by the specified entity, and the net value of such consideration shall be considered for a reduction on from the written down value of such block.

Link: https://www.incometaxindia.gov.in/communications/circular/circular_14_2021.pdf

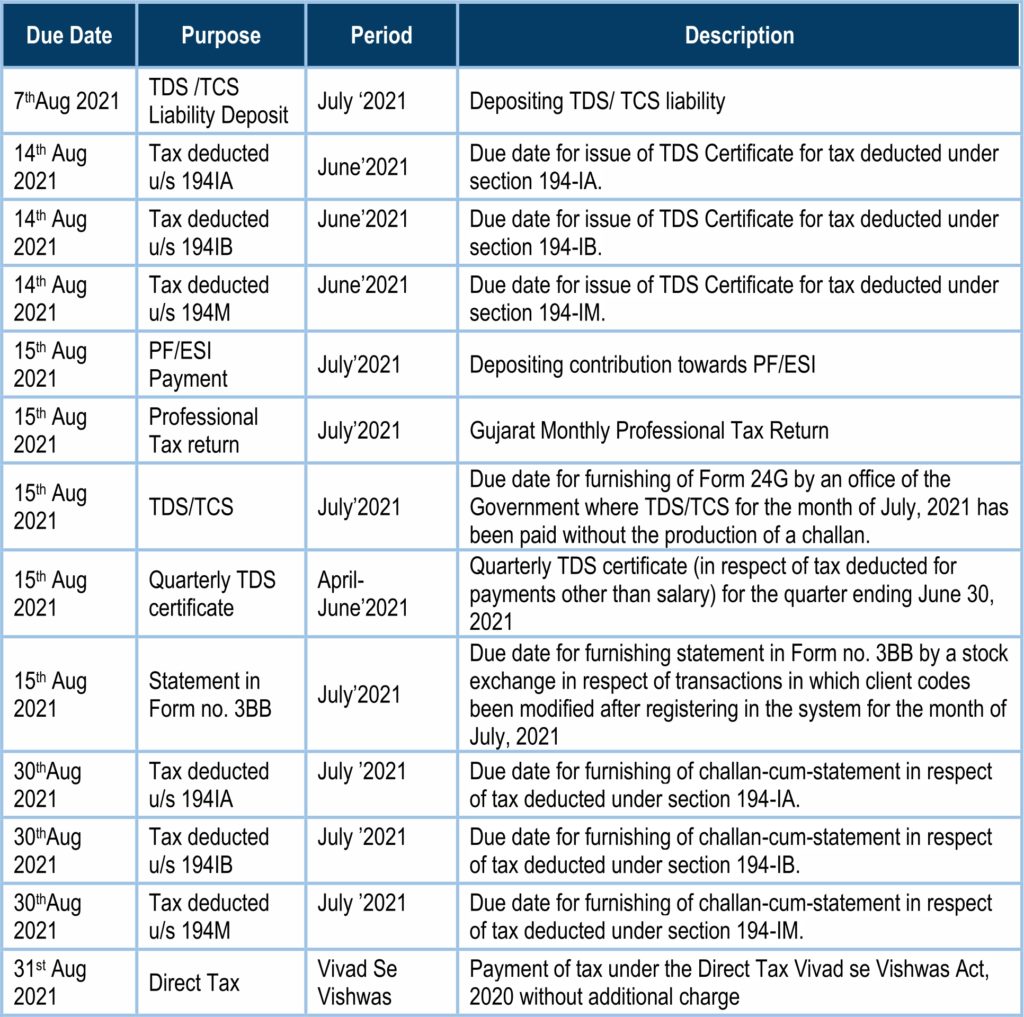

Income Tax Compliance Calendar August 2021

Indirect Taxation

Exempt taxpayers having AATO upto ₹ 2 crores from the requirement of furnishing annual return for FY 2020-21.

The Central Board of Indirect Taxes and Customs vide notification No. 31/2021-Central Tax on 30th July 2021 Seeks to exempt taxpayers having AATO upto ₹ 2 crores from the requirement of furnishing the annual return for FY 2020-21.

CBIC amends Rule 80 Annual Return, GSTR 9 and 9C for FY 2020-21.

CBIC has vided Notification No. 30/2021–Central Tax dated 30th July 2021 amended Rule 80 related to Annual GST Return, it further amended Instructions related to GSTR 9 and amended Form GSTR 9C.

The Government, on the recommendations of the Council, hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely:

In the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the said rules), for rule 80, the following rule shall be substituted, namely: ‑

Annual return: –

- Every registered person, other than those referred to in the second proviso to section 44, an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year as specified under section 44 electronically in FORM GSTR-9 on or before the thirty-first day of December following the end of such financial year through the common portal either directly or through a Facilitation Centre notified by the Commissioner:

Provided that a person paying tax under section 10 shall furnish the annual return in FORM GSTR-9A.

- Every electronic commerce operator required to collect tax at source under section 52 shall furnish annual statement referred to in sub-section (5) of the said section in FORM GSTR -9B.

- Every registered person, other than those referred to in the second proviso to section 44, an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, whose aggregate turnover during a financial year exceeds five crore rupees, shall also furnish a self-certified reconciliation statement as specified under section 44 in FORM GSTR-9C along with the annual return referred to in sub-rule (1), on or before the thirty-first day of December following the end of such financial year, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

Link: http://www.cbic.gov.in/resources//htdocs-cbec/gst/notfctn-30-central-tax-english-2021.pdf

Section 110 & 111 of Finance Act 2021 notified & put into effect from 01-08-2021

CBIC has vided Notification No. 30/2021–Central Tax dated 30th July 2021 seeks to notify Section 110 & 111 of Finance Act 2021 and put into effect from 01-08-2021. With this, the statutory requirement of (so-called) GST Audit by the CA/CMAs will no longer be there.

The amendments will also apply to FY 2020-21 and onwards.

Exempt basic customs duty on imports of specified API/ excipients for Amphotericin B and raw materials for manufacturing COVID test kits, till specified period.

CBIT has Exempt basic customs duty on imports of specified API/ excipients for Amphotericin B and raw materials for manufacturing COVID test kits vide Notification No. 35/2021-custom dated 12th July 2021.

- The Finance Ministry said the basic customs duty exemption on raw materials for manufacturing Covid test kits would be till September 30, 2021.

- While the exemption on specified API (active pharmaceutical ingredients)/ excipients for Amphotericin B would be valid till August 31.

Customs Brokers Licensing (Amendment) Regulations, 2021.

Central Board of Indirect Taxes and Customs amended Customs Brokers Licensing (Amendment) Regulations, 2021 vide Notification No. 62/2021-Customs (N.T.) on 23rd July 2021 abolished the requirement of periodic renewals of Licence/Registration issued to Customs Brokers and Authorised Carriers. Also, provision has been made to invalidate licences/registrations that are inactivity for more than a year.

Important Ruling

M/S. MALANKARA ORTHODOX SYRIAN CHURCH MEDICAL MISSION HOSPITAL

Offering a package to the inpatients covering the treatment including all required medicines and other supplies for a consolidated amount that is pre-fixed.

Held That: The combination of goods and /or services included in the supply are naturally bundled in the ordinary course of business and hence it is a composite supply of which the principal supply is healthcare services, and the other supplies are only incidental or ancillary to the supply of healthcare services. Therefore, the supply of medicines, implants, and other items to the inpatients admitted to the hospital for treatment as per the package offered by the applicant is a composite supply

Offering a package to the inpatients covering the treatment for a consolidated amount that is pre-fixed – package does not include medicines, implants and other supplies which will be separately billed according to the type, brand and quantity of the items as chosen by the inpatient as per the choice made available to them

HELD THAT: – The combination of the goods and/or services included in the supply are not bundled by the applicant and they are supplied as distinct and clearly identifiable individual supplies and the value of such individual supplies are separately determined according to the choice exercised by the inpatient. Hence it cannot be considered as a composite supply and the supply of each of the individual goods and/or services shall be individually liable to GST.

The package is not applicable, and the treatment, medicines and other supplies are charged separately according to the type, brand and quantity of items as per the choice of the patient

HELD THAT: – The combination of the goods and/or services included in the supply are not bundled by the applicant and they are supplied as distinct and clearly identifiable individual supplies and the value of such individual supplies are separately determined according to the choice exercised by the inpatient as made available. Hence it cannot be considered as a composite supply and the supply of each of the individual goods and/or services shall be individually liable to GST

Liability of GST – supply of medicines, implants and other items to patients undergoing treatment as outpatients – patients are not being admitted in hospital but the hospital is providing treatment to those patients at the hospital as an outpatient

HELD THAT: – In such cases, the services provided, or the combination of services provided during the treatment of the patients as described above clearly fall within the scope of healthcare services example includes Dialysis, dressing, chemotherapy, minor surgeries, other treatments and procedures that require no admission and preadmission services like causality.

Medicines and other supplies are issued to outpatients based on the prescription of their doctors for consumption at home and follow-up

HELD THAT: – In such cases the patients are consulting the doctors of the applicant and the patients are given advice and prescription of medicines and allied items by the Doctor. the supply of medicines and allied items by the pharmacy run by the hospital can only be treated as an individual supply of medicine and allied items and therefore is liable to GST at the rates applicable for each such item as per the GST Tariff Schedule.

The consultation services rendered by the applicant falls within the purview of healthcare services and accordingly, is exempted from GST

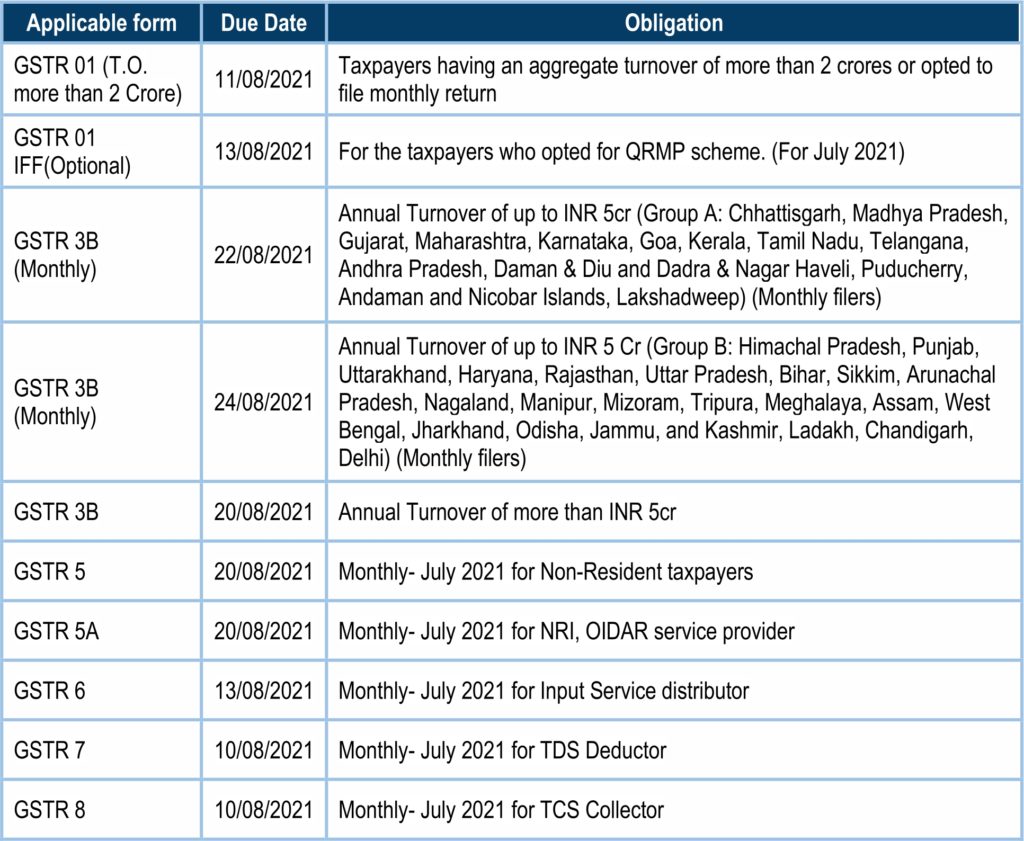

GST Compliance Calendar for August 2021

Ministry of Corporate Affairs (MCA)

Clarification on the spending of CSR funds for COVID-19 vaccination – reg.

The Ministry of Corporate Affairs vides General Circular no. 10/2020 dated 23.03.2020 clarified that spending of CSR funds for COVID-19 is an eligible CSR activity. In continuation to the said circular, it is further clarified that spending of CSR funds for COVID-19 vaccination for persons other than the employees and their families, is an eligible CSR activity under item no. (i) of Schedule VII of the Companies Act, 2013 relating to the promotion of health care including preventive health care and item no. (xii) relating to disaster management.

The companies may undertake the aforesaid activity subject to fulfilment of Companies (CSR Policy) Rules, 2014 and the circulars related to CSR issued by this Ministry from time to time.

Link: https://www.mca.gov.in/bin/dms/getdocument?mds=HbDqXuiLTcYlShFfT8wcuA%253D%253D&type=open

Companies (Incorporation) Fifth Amendment Rules, 2021

MCA notifies Companies (Incorporation) Fifth Amendment Rules, 2021 vide notification no. G.S.R. 503(E) dated 22nd July 2021. Vide this notification new Rule 33A. Allotment of a new name to the existing company under section 16(3) of the Act has been added after rule 33 of Companies (Incorporation) Rules, 2014 and new Form No.INC-11C has been inserted. Form No.INC-11C is a Certificate of Incorporation pursuant to change of name due to the Order of Regional Director not being complied.

If a company does not change the name of the company on the directions of Central Government within a period of 3 months as specified under section 16 of the Companies Act, 2013, the Central Government shall allot a new name to the company and the Registrar shall enter the same in the Registrar of Companies. Further, Registrar removes the old name and issue a fresh certificate of Incorporation with a new name in Form- 11C. Provided that nothing in this subsection shall prevent a company from subsequently changing its name in accordance with the provisions of section 13.

Link: https://www.mca.gov.in/bin/dms/getdocument?mds=xBAsF0oY7R3foZZqFw4y0A%253D%253D&type=open

List of forms providing waiver of additional fee as per Circular no. 11/2021 and 12/2021

Refer to the attached file for the list of forms for which additional fee waivers shall be made available/ extended in line with the general Circulars 11/2021 and 12/2021. Stakeholders may please take note and plan accordingly.

Link: https://www.mca.gov.in/bin/dms/getdocument?mds=xIk8LHJKnBG4BVxlUSaSFQ%253D%253D&type=open

SEBI

SEBI clarification regarding transactions in units of Exchange Traded Funds directly with Asset Management Companies

The Securities Exchange Board of India through circular dated July 30, 2021, issued to Mutual Funds (MFs) and Asset Management Companies has provided clarification regarding transactions in units of Exchange Traded Funds directly with Asset Management Companies. The circular provides that for the above-mentioned transactions, intra-day NAV, based on the executed price at which the securities representing the underlying index or underlying commodity(ies) are purchased/sold, shall be applicable.

Appropriate disclosure in this regard shall be provided in the Scheme Information Document, Key Information Memorandum and Common application form.

SEBI clarification to MF/AMCs regarding deployment of unclaimed redemption and dividend amounts and Instant Access Facility in Overnight Funds

The Securities Exchange Board of India through circular dated July 30, 2021, issued to Mutual Funds (MFs) and Asset Management Companies has provided clarification regarding deployment of unclaimed redemption and dividend amounts and Instant Access Facility in Overnight Funds. The circular provides that:

- The unclaimed redemption and dividend amounts, that are currently allowed to be deployed only in call money market or money market instruments, shall also be allowed to be invested in a separate plan of only Overnight scheme / Liquid scheme / Money Market Mutual Fund scheme floated by Mutual Funds specifically for deployment of the unclaimed amounts.

- AMCs shall not be permitted to charge any exit load in this plan and TER (Total Expense Ratio) of such plan shall be capped asper the TER of direct plan of such scheme or at 50bps whichever is lower.

- MFs/ AMCs can offer Instant Access Facility (IAF) only in Overnight and Liquid Schemes of the MF.

SEBI relaxes timelines for compliances by Trading members/Clearing Members & KYC Registration Agencies

The Securities Exchange Board of India through circular dated July 30, 2021, has extended the timelines for compliances by Trading members/Clearing Members & KYC Registration Agencies. The due date for the following compliances is extended from July 31, 2021, to September 30, 2021:

- KYC application form and supporting documents of the clients to be uploaded on a system of KRA within 10 working days.

- Submission of Internal Audit Report for Half-year ended

- System Audit /Cyber Audit Report – Algo / Type III Members for the period ended March 31, 2021.

- Submission of System Audit Report for the period ended March 2021.

- Submission of Cyber Security & Cyber Resilience Audit Report for the period ended March 2021.

- Reporting of Risk-Based Supervision.

- Maintaining call recordings of orders/instructions received from clients.

The due date to operate the trading terminals from designated alternate locations is extended from July 31, 2021, till December 31, 2021.