Direct Taxation

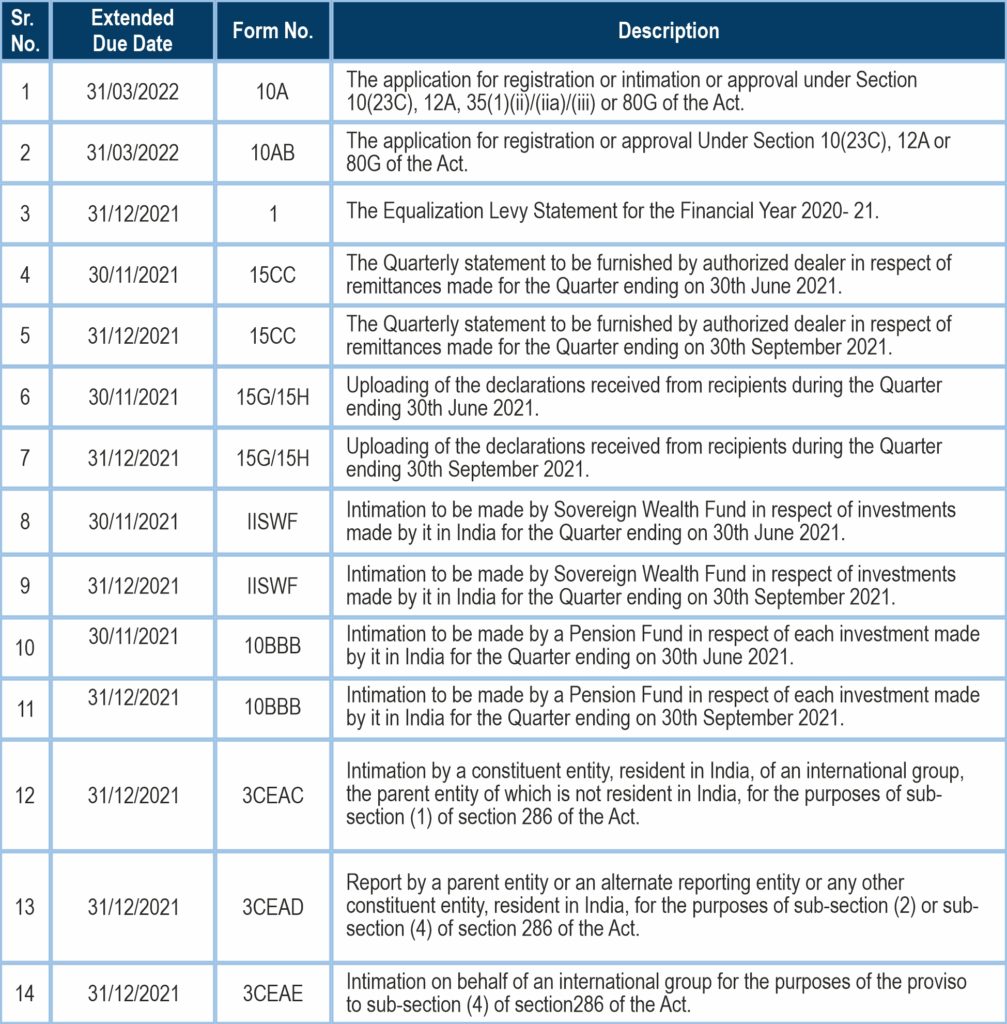

CBDT extends due dates for electronic filing of various Forms under the Income-tax Act, 1961.

Central Electricity Authority provides officials the option to deduct TDS under new or old Income Tax rates

The Central Electricity Authority through 11.08.2021 has provided the officials the option to deduct TDS under new or old Income Tax rates. The circular provides the new and old rates and the officials shall exercise their option in writing to choose between old and new rates for FY 2021-2022 (AY 2022-2023) for the purpose of monthly income tax deductions from pay and allowances. This option should be sent to the Cash-1 section as per the format prescribed in the circular within 10th September 2021.

MCA (Ministry of Corporate Affairs)

DIR -3 KYC

Director KYC submission for DIN holders as of 31st March 2021 – Every person who has a DIN allotted and status of the DIN is approved needs to file Form DIR 3 and update DIN KYC on or before 30th September’2021

GST

Date for filing application for revocation of cancellation of registration extended

In view of the notification 34/2021 -Central dated 29th Aug 2021, where the due date of filing of an application for revocation of cancellation of registration falls between 1st March 2020 to 31st August 2021, the time limit for filing of an application for revocation of cancellation of registration is extended to 30th September 2021.

The benefit of the said notification is extended to all the cases where cancellation of registration has been done under clause (b) or clause (c) of sub-section (2) of section 29 of the CGST Act, 2017 and where the due date of filing of an application for revocation of cancellation of registration falls between 1st March 2020 to 31st August 2021.

It is further clarified that the benefit of notification would be applicable in those cases also where the application for revocation of cancellation of registration is either pending with the proper officer or has already been rejected by the proper officer.

CBIC relaxes the due date for export of gold/ silver/ platinum under the scheme for ‘Export against Supply by Nominated Agencies’

The Central Board of Indirect taxes through a notification dated 19th August 2021 has amended the prior notification dated the 8th May 2000. The original notification exempts silver, gold, and platinum imported into India as replenishment under the Scheme for ‘Export through Exhibitions/Export promotion Tours/Export of Branded Jewellery’ or under the Scheme for ‘Export against Supply by Nominated Agencies from the whole of the duty of customs leviable under the Customs Tariff Act.

In the case of import of gold/ silver/ platinum under the scheme for ‘Export Against Supply by Nominated Agencies’, the importer executes a bond undertaking to export gold/silver/platinum jewellery or articles, as the case may be, including studded articles having gold/silver/ platinum content equivalent to the imported gold/silver/ platinum within a period of 120 days from the date of issue of gold/silver/platinum to the exporters.

The amendment provides that gold/ silver/ platinum imported under the scheme for ‘Export Against Supply by Nominated Agencies’, where the last date of exports falls between the 1st February 2021 and the 30th June 2021, the last date of exports stands extended by six months, in order to levy customs duty exemption.

Customs tariff duty relaxation for oil products

The Department of Revenue through customs notification dated the 19th August 2021 has amended the notification dated the 29th June 2021, which provided for a relaxation of customs tariff duty for oil products. The amendment has reduced the customs tariff duty for the following products to corresponding rates:

- Sunflower seed oil: standard rate is reduced from 100% to 7.5

- Sunflower oil, edible grade: standard rate is reduced from 100% to 37.5%

- Crude oil, whether or not degummed: standard rate is reduced from 45% to 7.5%

Further relaxation of customs duty and health cess for products used to combat Covid-10

The Ministry of Finance through a notification dated 24 August 2021 has extended the exemption given to customs duty and health cess for products used to combat Covid-10 till 30th September 2021. The Ministry through the prior notification dated April 24, 2021, has exempted the following goods, when imported into India, from the whole of the duty of customs leviable thereon under the said First Schedule and the whole of health cess leviable thereon:

- Oxygen concentrator including flow meter, regulator, connectors and tubings.

- Medical Oxygen

- Vacuum Pressure Swing Absorption (VPSA) and Pressure Swing Absorption (PSA) oxygen plants, Cryogenic oxygen Air Separation Units (ASUs) producing liquid/gaseous oxygen.

- Oxygen canister.

- Oxygen filling systems.

- Oxygen storage tanks

- Oxygen generator

- ISO containers for Shipping Oxygen 9.

- Cryogenic road transport tanks for Oxygen

- Oxygen cylinders including cryogenic cylinders and tanks

- Ventilators, including ventilator with compressors; all accessories and tubings; humidifiers; viral filters (should be able to function as high flow device and come with nasal canula).

- High flow nasal canula device with all attachments; nasal canula for use with the device.

- Helmets for use with non-invasive ventilation.

- Non-invasive ventilation oronasal masks for ICU ventilators.

- Non-invasive ventilation nasal masks for ICU ventilators.

- COVID-19 vaccine.

SEBI

SEBI imposes an additional 3% penalty on repeated default by sellers.

The Securities and Exchange Board of India vide its notification dated 17th August 2021 has imposed additional penalties for repeated delivery default in order to strengthen the delivery mechanism and ensure market integrity.

Sebi, in consultation with clearing Corporations (CCs), has decided that in the case of repeated defaults by a seller or a buyer, for each instance of repeated default an additional penalty shall be imposed. Which shall be 3 % of the value of the delivery default.

Repeated Default shall be defined as an event, wherein a default on delivery obligations takes place 3 times or more during a six months period on a rolling basis and the penalty levied shall be transferred to the Settlement Guarantee Fund (SGF) of the Clearing Corporation.

Earlier in March, SEBI had fixed a penalty of 4 percent of the settlement price plus replacement cost on delivery default in agricultural commodities sellers. While in non-agricultural commodities, the penalty for delivery default by sellers will be at 3 percent of settlement price plus replacement cost.

The new framework will be effective after one month from the date of issuance of the circular.

SEBI has extended the Calendar Spread margin benefit in commodity futures contracts

The Securities Exchange Board of India through a circular dated August 9, 2021, has extended the Calendar Spread margin benefit in commodity futures contracts. SEBI previously prescribed norms for providing margin benefit on calendar spread positions in commodity futures contracts for the first three expiries. Considering the possible benefits likely to accrue to the investors, in consultation with clearing corporations, it has been decided to extend the spread margin benefit beyond the first three expiries.

The Incase of calendar spreads or spreads consisting of two contract variants having the same underlying commodity (wherein currently 75% benefit in initial margin is permitted), benefit in initial margin shall be permitted when each individual contract in the spread is from amongst the first six expiring contracts.

SEBI modifies Operational Guidelines for FPIs and DDPs.

The Securities and Exchange Board of India on 4th August 2021 has modified the explanation provided under Para 2 (ii) (b) of Part A of the Operational Guidelines for FPIs and DDPs.

Para 2 deals with Guidance for Processing of foreign portfolio investors (FPI) applications by Designated Depository Participants (DDP) in which the DDP may obtain a requisite declaration from the applicant for satisfying eligibility criteria and the conditions mentioned below relating to NRIs, OCIs, and/or RIs being constituents of the applicant.

Where NRIs or OCI or RIs are constituents of the applicant, the contribution of a single NRI or OCI or RI shall be below twenty-five percent of the total contribution in the corpus of the applicant.

The aggregate contribution of NRIs, OCIs, and RIs shall be below fifty percent of the total contribution in the corpus of the applicant.

Explanation: The contribution of resident Indian individuals shall be made through the Liberalised Remittance Scheme (LRS) notified by Reserve Bank of India and shall be in global funds whose Indian exposure is less than 50%.”