Direct Taxation

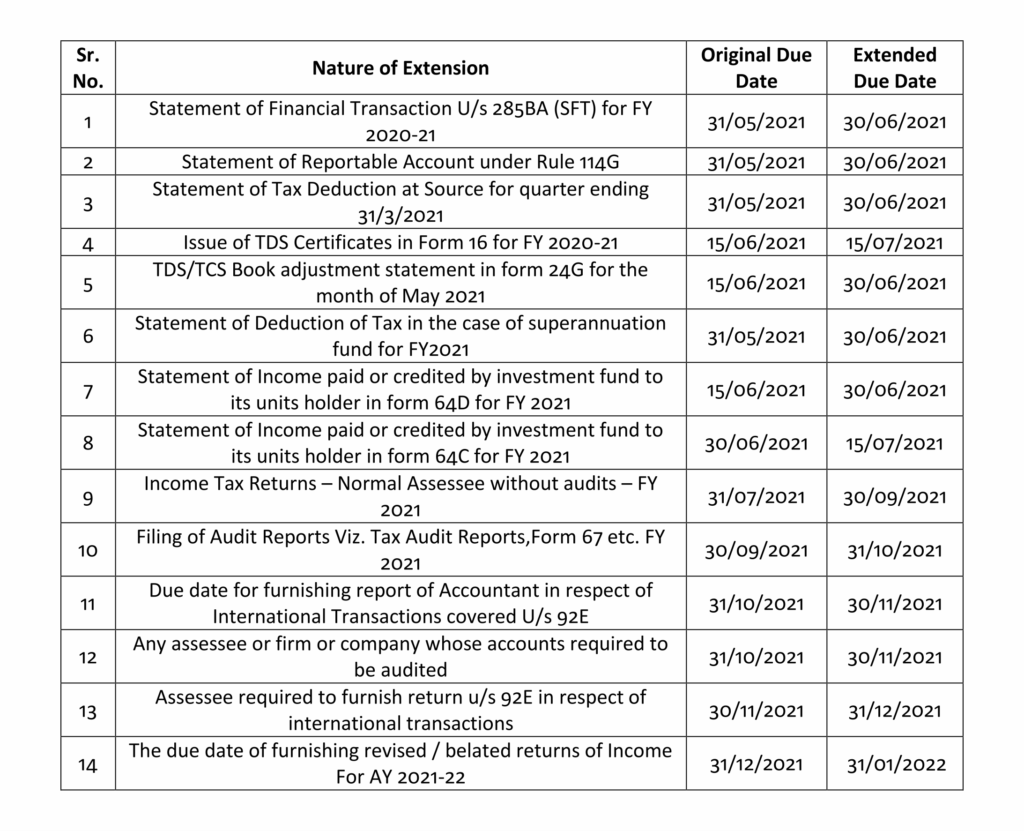

Extension of time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic.

The Central Board of Direct Taxes, in exercise of its power under section 119 of the Income-tax Act, 1961 (hereinafter referred to as “the Act”) provides relaxation in respect of the following compliances:

CBDT extends time limit for assessing officer to issue orders and intimations

The Central Board of Direct Taxes through notification dated 27th April 2021 has extended the timeline for the assessment authorities to issue following communications from 30 April 2021 to June 30, 2021:

- Any order for assessment or reassessment under the Income-tax Act.

- Any assessment order as per directions of dispute resolution panel.

- Issue of notice when assessment officer comes to possession of material evidence against the assessee who has evaded income assessment in a given year.

Sanction of Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner to assessing officer to issue notice when assessment officer comes to possession of material evidence against the assesses who has evaded income assessment in a given year after the expiry of a period of four years from the end of the relevant assessment year.

CBDT extends due date of compliances under Direct Tax Vivad se Vishwas Act

The Central Board of Direct Taxes on 27th April 2021 has extended the time limit for making payment of amount payable under the Direct Tax Vivad se Vishwas Act, 2020 by two months till 30th June 2021 due to COVID pandemic. Further the payment date of the amount of the disputed tax with 10% additional amount has been extended till 1st July 2021.

CBDT eases Income Tax norms for cash received by hospitals providing covid treatment.

The Central Government, in exercise of powers conferred by clause (iii) of Proviso to Section 269ST of the Income-tax Act, 1961, hereby specifies Hospitals, Dispensaries, Nursing Homes, Covid Care Centers or similar other medical facilities providing Covid treatment to patients for the purpose of Section 269ST of the Income-tax Act, 1961 for payment received in cash during 01.04.2021 to 31.05.2021, on obtaining the PAN or AADHAAR of the patient and the payer and the relationship between the patient and the payer by such Hospitals, Dispensaries, Nursing Homes, Covid Care Centers or similar other medical facilities.

The provision of section 269ST, states that no person shall receive an amount of Rs. 2 Lakhs or more in aggregate from a person in a day; or in respect of a single transaction; or in respect of transactions relating to one event or occasion from a person, otherwise than by an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account or through such other electronic mode as may be prescribed.

However due to the current pandemic, the board has relaxed the provisions of section 269ST of the Income Tax Act.

Clarification regarding the limitation time for filing of appeals before the CIT(Appeals) under the Income-tax Act, 1961

The Central Board of Direct Taxes has issued Circular No. 8 of 2021 on 30th April 2021 providing various relaxations till 31st May 2021 including extending time for filing the appeals before CIT(Appeals). At the same time, the Hon’ble Supreme Court vide order dated 27th April 2021 in Suo Motu Writ Petition (Civil) No. 3 of 2020 restored the order dated 23rd March, 2020 and in continuation of the order dated 8th March, 2021 directed that the period(s) of limitation, as prescribed under any General or Special Laws in respect of all judicial or quasi-judicial proceedings, whether condonable or not, shall stand extended till further orders. The Central Board of Direct Taxes clarifies that if different relaxations are available to the taxpayers for a particular compliance, the taxpayer is entitled to the relaxation which is more beneficial to him. Thus, for the purpose of counting the period(s) of limitation for filing of appeals before the CIT(Appeals) under the Act, the taxpayer is entitled to a relaxation which is more beneficial to him and hence the said limitation stands extended till further orders as ordered by the Hon’ble Supreme Court in Suo Motu Writ Petition (Civil) 3 of 2020 vide order dated 27th April 2021.

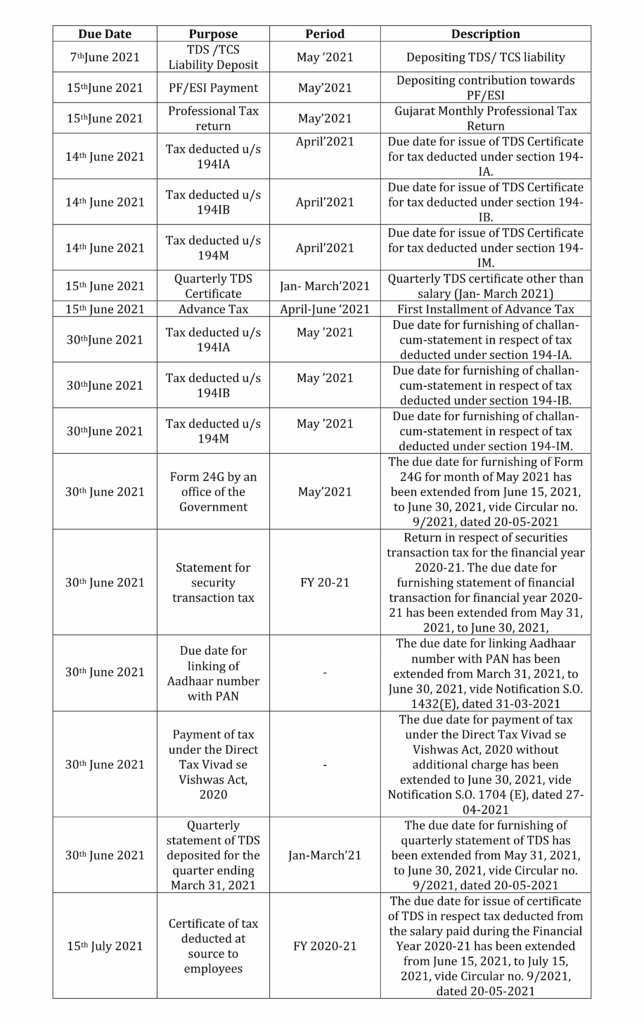

Income Tax Compliance Calendar June 2021

Indirect Taxation

CBIC extends penalty waiver on dynamic QR code implementation till June 30, 2021

Central Board of Indirect Taxes vide its notification dated 30th March 2021 has waived of the penalty for non-compliance of capturing dynamic QR code in GST Invoice from December 2020 to June 30, 2021, fixed deadline of compliance to July 1, 2021.

The Board specifies that three-month waiver will be applicable subject to the condition that compliance will be necessarily undertaken from July 1, 2021.

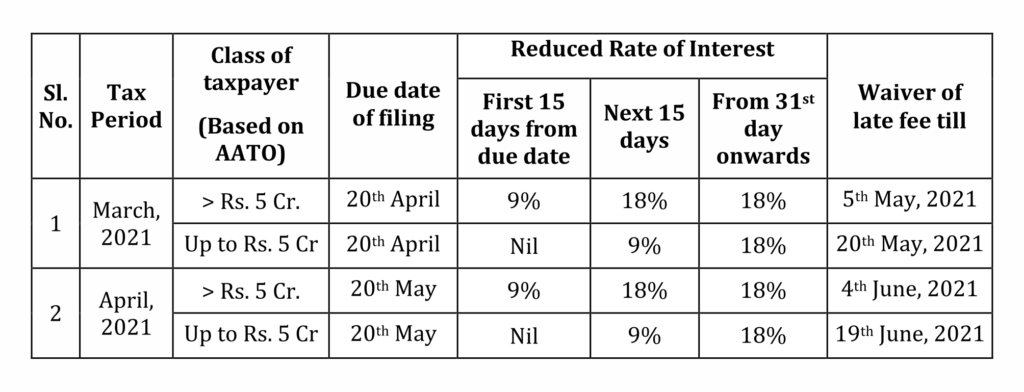

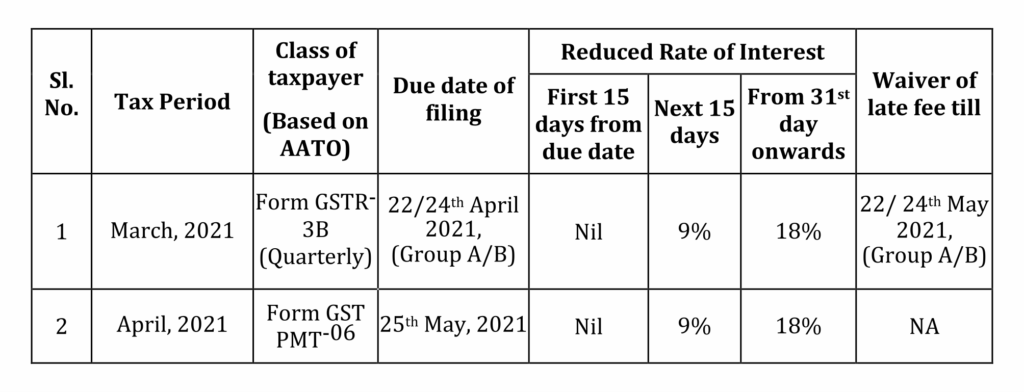

Waiver of interest and late fee to normal taxpayers (filing return on monthly or quarterly basis) and composition taxpayers, for the tax periods of March and April 2021

Government has granted waiver from payment of interest and/or late fee to normal (Monthly / Quarterly) & composition taxpayers for the tax periods of March and April, 2021, through Central Tax Notification Nos. 08/2021 and 09/2021, both dated 1st May, 2021.

Relaxation to normal taxpayers in filing of monthly return in Form GSTR-3B

Relaxation in filing of Form GSTR-3B (Quarterly) by Taxpayers under QRMP Scheme

Relaxations in filing Form CMP-08 for Composition Taxpayers:

For Quarter of Jan-March 2021, instead of 18th April 2021, Composition Taxpayers can now file their quarterly return in Form CMP-08, without interest up to 3rd May 2021, with 9% reduced interest between 4th May to 18th May 2021, and with 18% interest from 19th May 2021 onwards.

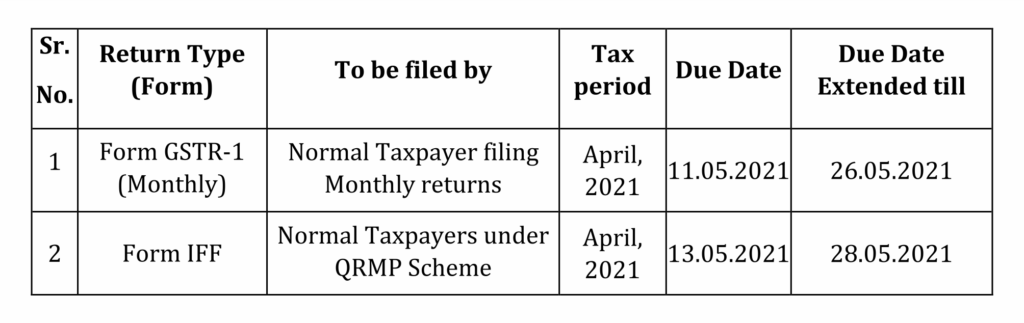

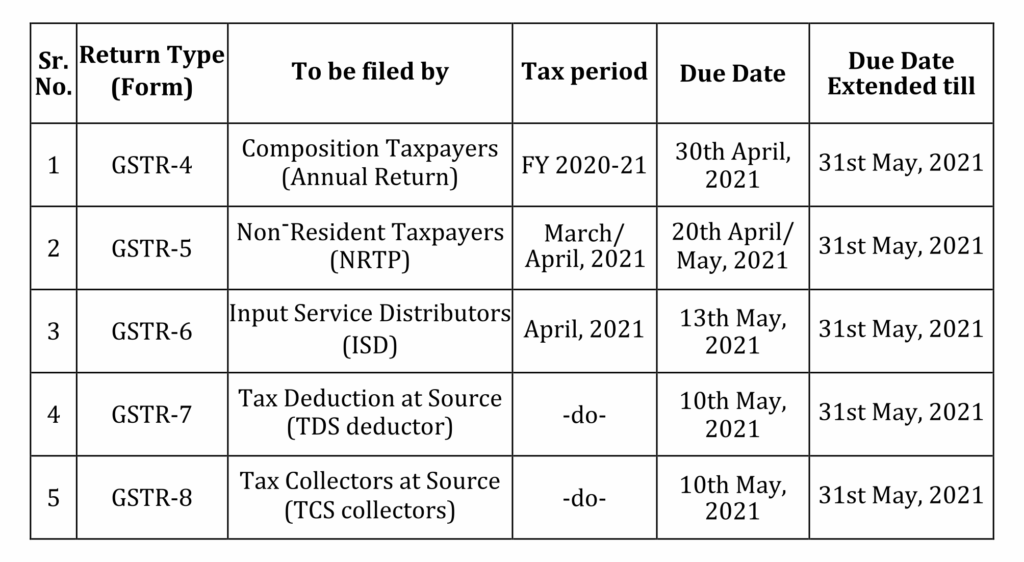

Extension in dates of various GST Compliances for GST Taxpayer

Government has extended the dates of various compliances by Taxpayers under GST, through Central Tax Notification Nos.10/2021, 11/2021, 12/20211, 13/2021, 14/2021, all dated 1st May, 2021. The details are summarized below:

Filing of Form GSTR-1/IFF by Normal Taxpayers:

Filing of Returns by Composition, NRTP, ISD, TDS & TCS Taxpayers:

Filing of Form ITC-04:

The due date for filing of Form GST ITC-04 (to be filed by Principal/Manufacturer for goods sent/received/supplied from Job Worker) for the quarter Jan-March 2021, (due date 25th April 2021) has been extended till 31st May 2021.

CBIC notifies Central Goods and Services Tax (Fourth Amendment) Rules, 2021.

The Central Board of Indirect Taxes and Customs on 18th May 2021 has published the Central Goods and Services Tax (Fourth Amendment) Rules, 2021 by bringing in changes to refund related rules.

The Amendment is brought under Rule 23 which deals with revocation of cancellation of registration in which a registered person, whose registration is cancelled by the proper officer on his own motion, may submit an application for revocation of cancellation of registration, in FORM GST REG-21, to such proper officer, within a period of thirty days from the date of the service of the order of cancellation of registration or within such time period as extended by the Additional Commissioner or the Joint Commissioner or the Commissioner, as the case may be, in exercise of the powers provided under the proviso to sub-section (1) of section 30, at the common portal.

Further under 90, Where any deficiencies are noticed, the proper officer shall communicate the deficiencies to the applicant in FORM GST RFD-03 through the common portal electronically, requiring him to file a fresh refund application after rectification of such deficiencies

Provided that the time period, from the date of filing of the refund claim in FORM GST RFD-01 till the date of communication of the deficiencies in FORM GST RFD-03 by the proper officer, shall be excluded from the period of two years as specified under sub-section (1) of Section 54, in respect of any such fresh refund claim filed by the applicant after rectification of the deficiencies.”

Further under rule 90(5) The applicant may, at any time before issuance of provisional refund sanction order in FORM GST RFD-04 or final refund sanction order in FORM GST RFD-06 or payment order in FORM GST RFD-05 or refund withhold order in FORM GST RFD-07 or notice in FORM GST RFD-08, in respect of any refund application filed in FORM GST RFD-01, withdraw the said application for refund by filing an application in FORM GST RFD-01W.

On submission of application for withdrawal of refund in FORM GST RFD-01W, any amount debited by the applicant from electronic credit ledger or electronic cash ledger, as the case may be, while filing application for refund in FORM GST RFD-01, shall be credited back to the ledger from which such debit was made.

GSTN extends the due date for filing of Revocation application of Cancellation.

The Goods and Service Tax on 14th May 2021 has extended the timeline for filing the ‘Application for Revocation of Cancellation’ to 180 days from 90 days, which shall be valid up to 15th June 2021.

The Taxpayer shall visit the GST portal for applying revocation or restoration of GST registration cancelled by tax officials and the timeline for filing such application has been extended to 180 days which will be valid up to 15th June 2021.

The GSTN has notified this extension, in view of the Notification issued by CBIC wherein the timeline for all other proceedings, asset order, etc., where the last date of completion or compliance under GST law falls between 15th April to 30th May is extended to 31st May 2021.

Highlights of 43rd GST Council meeting dated 28.05.2021

- Council has decided to exempt export of relief items and is being extended till August 31, 2021.

- Import of medicine for black fungus, that is Amphotericin B, has also been included in the exempted category.

- Import of Covid-related relief items, even if purchased or meant for donating to government or to any relief agency upon recommendation of state authority, to be exempted from IGST till August 31, 2021.

- FM Sitharaman announced Amnesty Scheme to reduced late fee returns. Small taxpayers can file pending returns under this scheme.

- A Group of Ministers will be quickly formed who will submit their report within 10 days – on or before June 8, so that if there are any further reductions which need to be done will be done, in the sense, that rates will be decided by them.

In detail it is mentioned in press release enclose herewith.

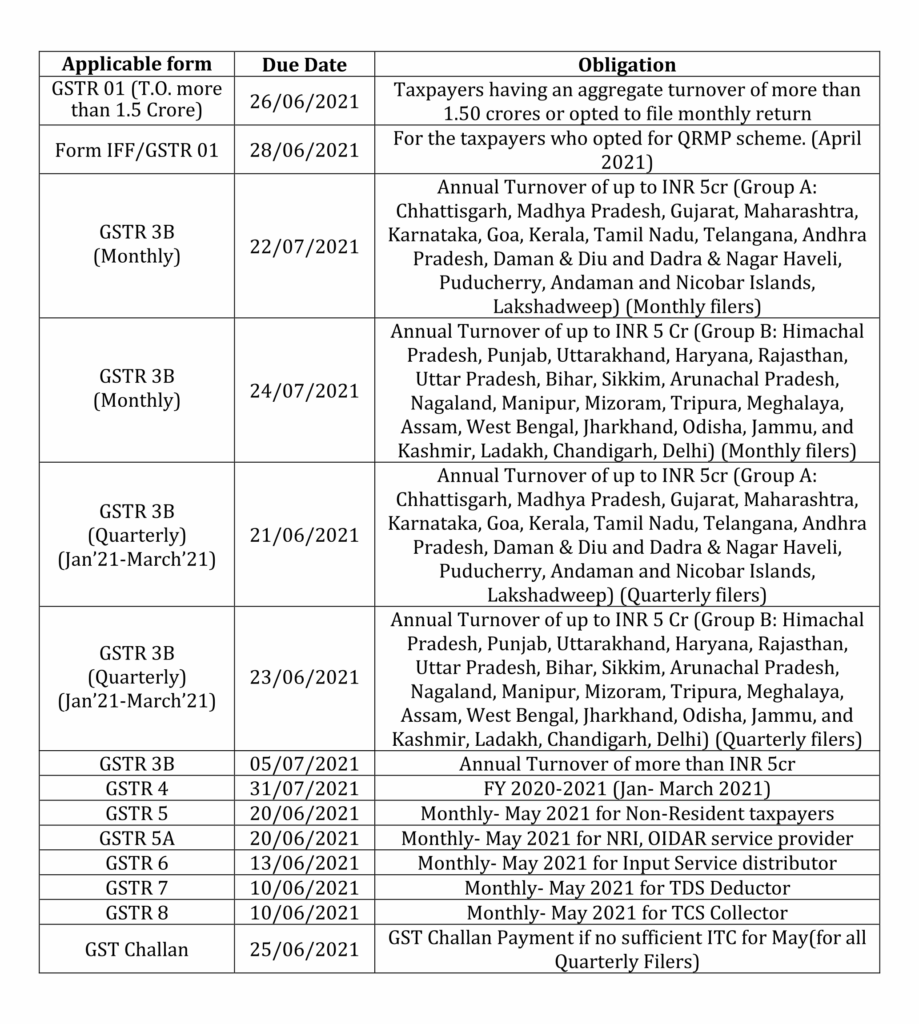

GST Compliance Calendar for June 2021

Ministry of Corporate Affairs (MCA)

Gap between two board meetings under section 173 of the Companies Act, 2013

In view of difficulties arising due to resurgence in COVID-19 and requests received from stakeholders, it has been decided that the requirement of holding meetings of the Board of the companies within the intervals provided in section 173 of the Companies Act 2013 (120 days) stands extended by period of 60 days for first two quarters of financial year 2021-2022. Accordingly, the gap between two consecutive meetings of the board may extend to 180 days during the Quarter April-June 2021 and Quarter July -Sept 2021, instead of 120 days as required by Companies Act 2013.

Relaxation of time for filing forms related to creation or modification of charges under the Companies Act, 2013

The MCA issued General Circular No. 7 dated May 03, 2021, for relaxation of time for filing forms related to creation or modification of charges under the Companies Act, 2013.

On account of the resurgence of COVID-19 pandemic, representations have been received in this Ministry requesting relaxation of timelines related to filing of certain charge related forms. The representations have been examined and the Central Government has, in exercise of its powers under section 460 read with section 403 of the Companies Act, 2013 (Act) and the Companies (Registration Offices and Fees) Rules, 2014, decided to allow relaxation of time and condone the delay in filing forms related to creation/ modification of charges as per details given in para 2 of this Circular.

Relaxation on levy of additional fees in filing of certain Forms under the Companies Act, 2013 and LLP Act 2008.

Requests have been received from stakeholders for relaxation on levy of additional fees for filing of various forms under the Companies Act, 2013/LLP Act, 2008/Rules made thereunder due for filing during 1st April 2021 to 31st May 2021 in view of the COVID-19 related restrictions and disruption. The requests have been examined and taking into account the difficulties which have arisen due to resurgence ofCOVID-19 pandemic, it has been decided to grant additional time upto 31st July, 2021 for companies/LLPs to file such forms (other than a CHG-1 Form, CHG-4 Form and CHG-9 Form) without any additional fees. Accordingly, no additional fees shall be levied upto 31st July 2021 for the delayed filing of forms (other than charge related forms referred above) which were /would be due for filing during 1st April 2021 to 31st May 2021. For such delayed filings upto 31st July 2021 only normal fees shall be payable.

Clarification on spending of CSR funds for ‘creating health infrastructure for COVID care, establishment of medical oxygen generation and storage plants’ etc

In continuation to this Ministry’s General Circular No. 10/2020 dated 23.03.2020, wherein it was clarified that spending of CSR funds for COVID-19 is an eligible CSR activity, it is further clarified that spending of CSR funds for ‘creating health infrastructure for COVID care’, ‘establishment of medical oxygen generation and storage plants’, ‘manufacturing and supply of Oxygen concentrators, ventilators, cylinders and other medical equipment for countering COVID-19’ or similar such activities are eligible CSR activities under item nos. (i) and (xii) of Schedule VII of the Companies Act, 2013 relating to promotion of health care, including preventive health care, and, disaster management respectively.

Offsetting of excess Contribution of CSR funds to PM CARES made in FY 2019-20 against the requirement of CSR spending in FY 2020-21

Many companies who have contributed CSR funds to the ‘PM CARES Fund’ over and above their prescribed CSR amount for FY 2019-20 had represented to the MCA for setting off the excess CSR amount spent by the companies in FY 2019-20 by way of contribution to ‘PM CARES Fund’ against the mandatory CSR obligation for FY 2020-21.

The MCA has examined the representation and issued a circular clarifying that where a company has contributed any amount to ‘PM CARES Fund’ on 31.03.2020, which is over and above the minimum amount as prescribed under section 135(5) of the Companies Act, 2013 (“Act”) for FY 2019-20, and such excess amount or part thereof is offset against the requirement to spend under section 135(5) for FY 2020-21 in terms of the aforementioned appeal, then the same shall not be viewed as a violation.

Solution will be provided in next Newsletter.